In common parlance, “Taper” means a gradual narrowing and “Tantrum” means sudden outburst of emotions. In economic parlance, “Taper Tantrum” was the word coined during 2013 when the US Federal Reserve (US Fed) announced future reduction (tapering) of its quantitative easing leading to surge in the US Treasury yields.

What is Quantitative Easing (QE)?

It is a monetary policy action by central banks like US Fed to purchase government bonds to infuse money into the economy to expand economic activity.

Why is QE done?

QE is an attempt towards decreasing interest rates, increasing the supply of money and in turn, lending to consumers and businesses by financial institutions. This will help in stimulating the economic activity during the financial crisis.

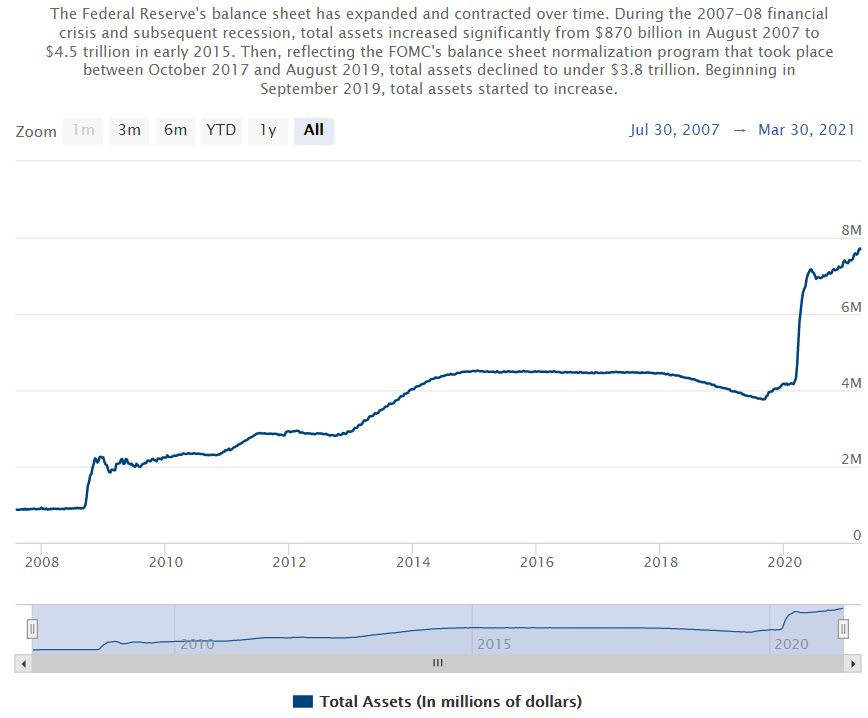

FinFact: The US Fed bought ~ USD 3 trillion of treasury bonds and mortgage-backed securities during the three rounds of QE from 2008 to 2013. Compared to that, in just one year, since the covid pandemic, US has infused ~ USD 4 trillion into the financial system!

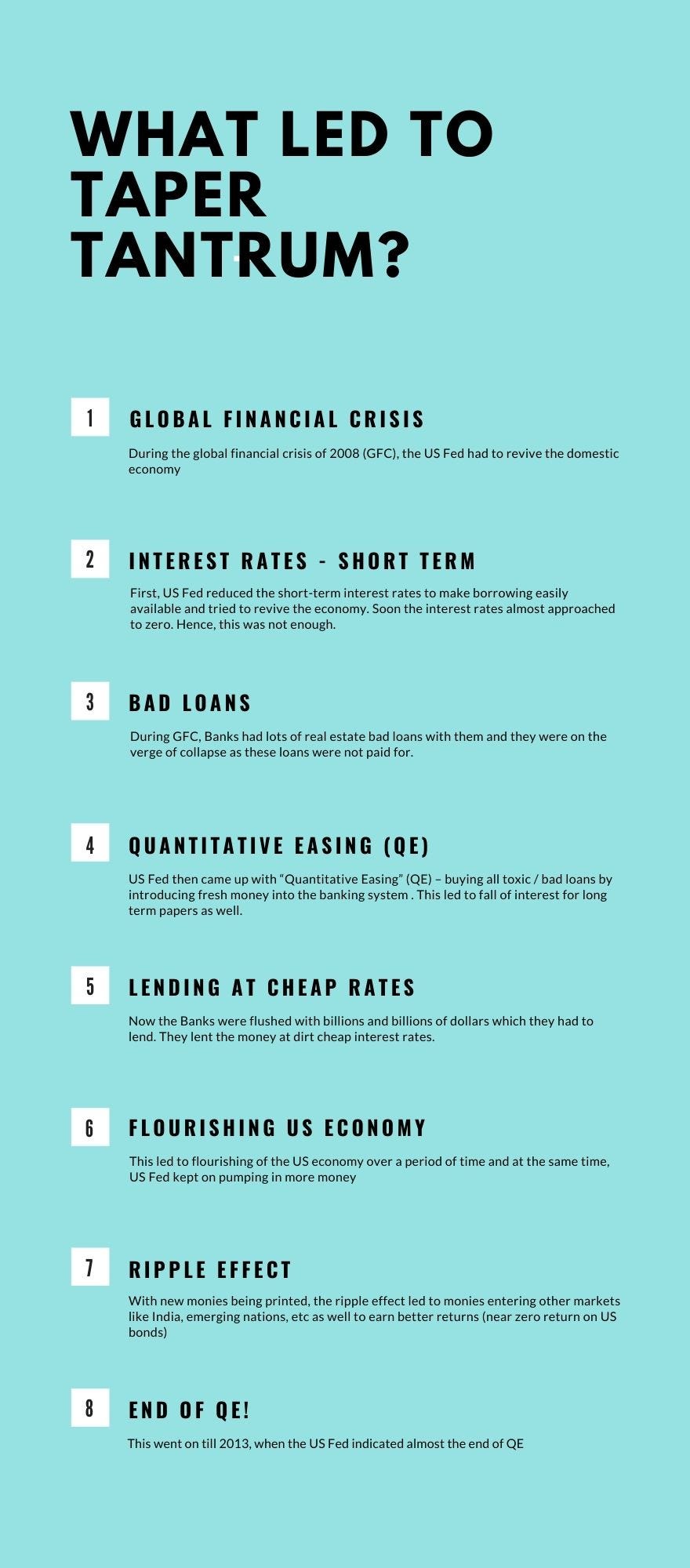

What led to Taper Tantrum?

What happened after the start of the end of QE?

As mentioned earlier, the monies flowed to emerging nations to earn better return. However, when the Fed signaled easing of QE, the anticipation was an increase in interest rates in US. US investors realized that they no longer needed to be in emerging nations and they started to pull out their monies quickly. This led to sudden outflow of foreign capital from countries like India and as an effect, rupee depreciated almost 15% in span of 4-5 months. This entire episode has been described as “Taper Tantrum”: Taper as US Fed eased QE and Tantrum as foreign investors over-reacted by sudden withdrawal from many markets.

Why are we hearing Taper Tantrum now?

We are in similar situation like 2013, where US Fed and other nations have infused liquidity into the system. With economic activities coming back to normalcy, the QE will be eased out and this will again lead to rise in interest rates. The 10 year US Treasury yields have moved from 0.93% at the start of 2021 to 1.74% on 31st March 2021. This can lead to a knee-jerk reaction from foreign investors and might lead to similar capital outflows and hence, we are again hearing about Taper Tantrum.

But at the same time…

…and hence, from the above table, it seems that these are still early days to call the current events as “Taper Tantrum”. The Indian economy has grown over time. Also, the Central Banks around the world would have learnt from their past experience to not withdraw stimulus at one go.

This is a developing story and let us watch out this space on what happens next!

Please do drop in your comments on the article in the link below:

Second lastly, do not forget to share the article with your friends and family!

And lastly, do subscribe to FinFacts! :-)

Nice Read!